Tesla (TSLA) is set to announce its first-quarter 2021 financial results today, April 26, after the markets close. As usual, a conference call and Q&A with Tesla’s management is scheduled after the results.

We’ll take a look below at what both the street and retail investors are expecting for the quarterly results.

Tesla Q1 2021 deliveries

As usual, Tesla’s vehicle deliveries drive most of its earnings results, since vehicle sales represent the automaker’s main revenue stream at the moment.

Tesla already released its Q1 2021 numbers confirming that it delivered 184,800 cars and produced more than 180,000 vehicles between January and March 2021.

That’s a new quarterly record – marginally beating the previous record, which was only achieved last quarter, but more importantly, it’s a massive 110% year-over-year increase.

Delivery and production numbers are always slightly adjusted during earning results.

Tesla Q1 2021 revenue

Analysts had to scramble and quickly increase their revenue estimates since the delivery consensus prior to the release of the delivery results was off by 15-20%.

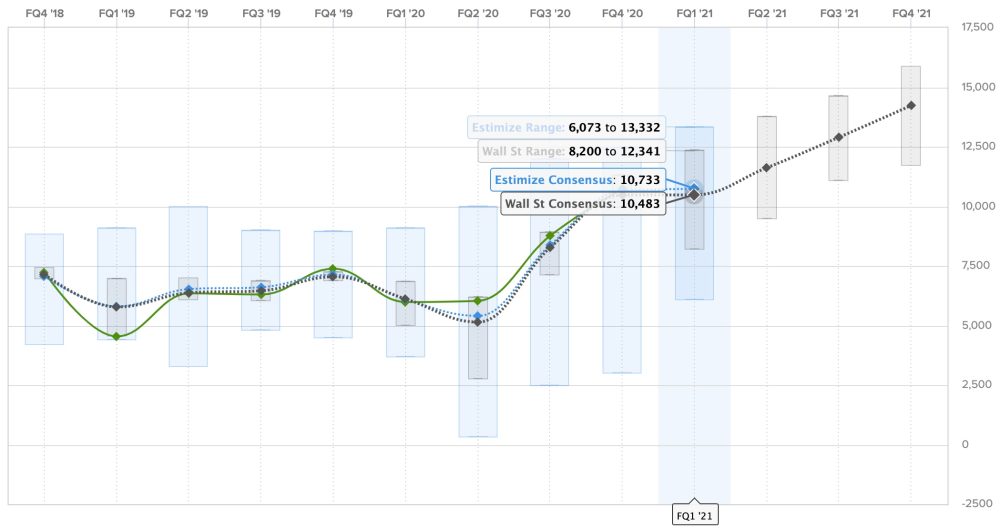

For revenue, the Wall Street consensus now stands at $10.483 billion, and Estimize, the financial estimate crowdsourcing website, predicts a higher revenue of $10.733 billion.

That’s roughly what Tesla reported last quarter despite delivering about 4,000 more vehicles in Q1, but it included a much lower mix of the more expensive Model S and Model X vehicles, which weren’t in production this quarter.

The predictions for Tesla’s revenue over the past two years: Estimize predictions are in blue, Wall Street consensus are in gray, actual results are in green:

Tesla Q1 2021 earnings

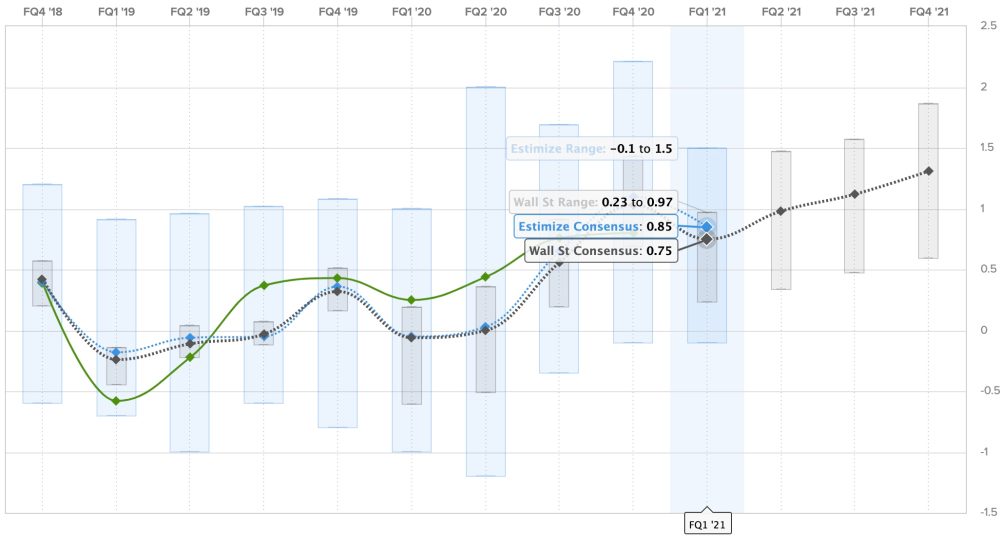

Tesla has been consistently beating earnings expectations over the last year except for the last quarter.

The market has adjusted its expectations in consequence, and it’s now a bit lower despite the delivery beat.

The Wall Street consensus is a gain of $0.75 per share for the quarter, while Estimize’s prediction is slightly higher with a profit of $0.85 per share.

Earnings per share over the last two years: Estimize predictions in blue, Wall Street consensus in gray, actual results in green:

Other expectations for the TSLA shareholder’s letter and analyst call

Tesla has some explaining to do regarding a few things this quarter.

The main one I think is going to be the Model S and Model X refresh. Tesla has been weird with the unveiling of the new versions of those vehicles.

They were unveiled during Tesla’s last earnings report. Elon Musk said another presentation about the new vehicle would come the following week, but that never happened.

He also said that deliveries would start in a matter of weeks, but that also didn’t happen.

We are going to need a decent update about the status of the Model S and Model X refresh and the reason behind the delays.

People have been suggesting potential part supply issues, which is a real possibility, but we have also been speculating about potential delays finishing the vehicle’s software, which is going to need a brand-new user interface due to the new screen formats.

Other than Model S and Model X, we expect some updates on the timelines for Gigafactory Berlin and Gigafactory Texas as they both move closer to Model Y production.

That’s probably the most important thing for investors this year, since when that new production capacity comes online could determine if Tesla can hit 1 million vehicles in 2021.

Along with vehicle production capacity, investors are going to want to hear more about the status of the new 4680 battery cell and the pilot production plant in Fremont.

It will be interesting to see if Tesla is willing to share what kind of production capacity they are hitting at that plant right now.

We always expect more comments about the Full Self-Driving Beta program, especially an update on the timeline for a wider release with the “download button” supposedly coming this quarter.

As for Tesla Energy, I’m sure a lot of people would like Elon to comment on the giant price hike that solar roof customers are experiencing right now.

I’ve seen a new one today that almost literally doubled in price from ~$57,000 to $103,000. That’s just crazy.

An explanation here would go a long way because Tesla employees haven’t been able to communicate much to customers.

At the same time, the company could explain what prompted the other recent changes to Tesla Energy, such as bundling solar products and Powerwall together.

What else are you looking for during Tesla’s earnings? Let us know in the comments section below, and join us later today for an extensive coverage of the earnings.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Business - Latest - Google News

April 26, 2021 at 05:07PM

https://ift.tt/3sSR6Gb

Tesla (TSLA) Q1 2021 earnings preview: Here’s what people are expecting - Electrek.co

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "Tesla (TSLA) Q1 2021 earnings preview: Here’s what people are expecting - Electrek.co"

Post a Comment