Bloomberg

EU Pushes Back on China With Powers to Thwart State-Backed Firms

(Bloomberg) -- The European Union is looking to strengthen its hand against the growing economic threat posed by China, with new powers targeted at foreign state-owned companies.The European Commission, the bloc’s executive arm, proposed new rules to levy fines and block deals, according to a draft obtained by Bloomberg. While China isn’t specifically mentioned in the proposal, the move follows complaints from European businesses that the Asian nation’s firms get support they can’t match.Chinese business groups have already complained about the latest initiative, which will need support from EU governments before they become final. The document is a draft and could still change before it’s set to be proposed next week.It’s the next step in the EU’s efforts to ward off China, building on a push by member states to protect strategic companies from takeovers by non-European buyers.Amid the steepest recession in almost a century, Europe has shown signs of increasing protectionism. EU governments have been debating the “repatriation” of supply chains after the pandemic exposed the region’s vulnerability to disruptions, while France and Germany say the bloc should allow the creation of “European champions” big enough to compete with the U.S and China.Member states have voiced growing alarm at the prospect of European companies being bought by firms with unlimited credit lines or being forced out of business because rivals can afford to sell below cost.The new rules would run in parallel with oversight on foreign direct investment, which European governments have been ratcheting up in the last few years to give them more power to stop deals over industries or sectors they view as crucial. The increased scrutiny can be imposed even for minority stakes of more than 10%.Germany blocked a Chinese bid for the first time in 2018 by vetoing the potential purchase of machine-tool manufacturer Leifeld Metal Spinning AG. Last year, Chancellor Angela Merkel’s government agreed to buy a 23% stake in CureVac AG, at the time a key player in the race for a coronavirus vaccine which had been the focus of takeover speculation from the U.S.Alongside similar moves in other member states, Germany’s cabinet on Tuesday approved more changes to rules on foreign investment to give the government enhanced powers to scrutinize transactions that could impact national security. The new regulations, which need parliamentary approval, are targeted at high-technology sectors like artificial intelligence, autonomous driving and quantum computing.France recently halted the purchase of grocery chain Carrefour SA by Canada’s Alimentation Couche-Tard Inc., citing food sovereignty and the need to secure supply chains amid the pandemic. The country also vetoed the Teledyne Technologies Inc.’s purchase of Photonis, a company that makes night-vision gear for the military, citing strategic interests.In recent weeks, Italy coordinated with France to protect truckmaker Iveco SpA from an takeover by China FAW Group Co. Prime Minister Mario Draghi also sent a message by blocking a bid by China’s Shenzhen Invenland Holdings Co. for the small semiconductor firm LPE SpA.Spain’s government has signaled it could block at least two deals, one involving a utility and another involving a maker of aviation components.Under the draft EU rules, companies that generate at least 500 million euros ($600 million) of revenue in Europe and received more than 50 million euros of support from a foreign state in the last three years will need the bloc’s approval for deals.The EU also wants to be able to fine companies as much as 10% of their yearly revenue if it finds a firm unfairly benefited from a foreign subsidy -- including an unlimited state guarantee or credit line that undercuts European rivals. It warns in the draft that it could cancel government contracts granted to firms that gain an unfair advantage from such subsidies.European officials are seeking the power to inspect companies’ offices outside of Europe, with the permission of the company and the knowledge of the foreign state, according to the draft.Regulators suggest ways that companies could allay concerns over subsidies, including granting rivals access to infrastructure, licensing on fair terms or publishing research. Companies can also reduce capacity or market presence, divest assets or refrain from investment, according to the document.The European Commission declined to comment and the Chinese mission to the EU didn’t respond to a request for comment.Despite the tougher stance, the EU continues to actively build business ties with China, including an investment agreement. The bloc has promoted the deal, which could enter into force early next year, as a way to rebalance economic relations with its second-largest trade partner.The accord expands access to the Chinese market for European investors in industries ranging from cars to telecommunications. It also seeks to tackle underlying Chinese policies deemed to be market-distorting, such as industrial subsidies, state control of enterprises and forced technology transfers.For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2021 Bloomberg L.P.

Business - Latest - Google News

April 29, 2021 at 03:05AM

https://ift.tt/3u1EfCX

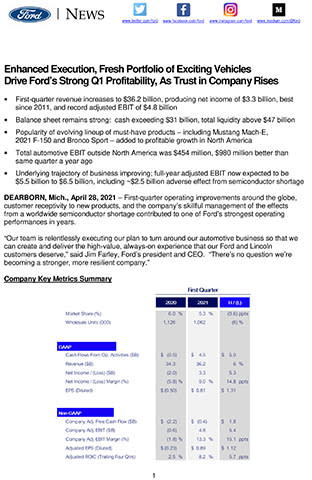

Enhanced Execution, Fresh Portfolio of Exciting Vehicles Drive Ford’s Strong Q1 Profitability, as Trust in Company Rises - Yahoo Finance

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "Enhanced Execution, Fresh Portfolio of Exciting Vehicles Drive Ford’s Strong Q1 Profitability, as Trust in Company Rises - Yahoo Finance"

Post a Comment