Makhbubakhon Ismatova/iStock via Getty Images

Investment Thesis

Medical Properties Trust, Inc. (NYSE:MPW) had a rough FQ4'22 earnings call, with the post sell-off triggering a drastic -$1.65B loss in the company's Enterprise Value since February 15, 2023.

We reckon this pessimism may be attributed to two major concerns shared by market analysts and investors alike

First, the potential bankruptcy of MPW's tenant, Prospect in Pennsylvania, due to the -$171M of real estate impairments and -$112M of write-downs from unbilled rental in FQ4'22. This builds upon other tenant issues the company has faced thus far, including the Pipeline Health's bankruptcy and Steward's cash flow issues.

This leads to our second point, MPW's dividend safety, attributed to the company's lower than expected FY2023 Normalized FFO [NFFO] per share of between $1.50 and $1.65. Those numbers suggest a worst case impact of up to -12.2% YoY, against its FY2022 levels of $1.71.

For now, we are not overly concerned yet, partly due to the management's optimistic commentary in realizing "the full return of its ($420M) investments in Prospects, including any deferred rent." Particularly, its FY2023 guidance in NFFO per share of up to $1.65 does not include rent from Pennsylvania for the next twelve months.

The NFFO per share guidance implies FY2023 FFO of between $890M and $990M, against FY2022 levels of $1.08B, with a mid-point impact of approximately -12.9% YoY. However, this sum suggests its capability in sustaining its current dividends, based on the $696M (+8.1% YoY) paid out in FY2022.

Nonetheless, we concur that there are notable risks in MPW's short-term execution, attributed to the elevated long-term debts of $10.26B (-9% YoY) and minimal cash/ equivalents on the balance sheet at $235.67M (-48.6% YoY) by the latest quarter. While most of its debt is well-staggered through 2031, in particular $483.32M will be due in 2023 and another $944.25M due in 2024, suggesting a potential refinancing at elevated interest rates.

On one hand, their hospital assets are essential businesses with current issues attributed to operators. However, it is undeniable that profitability headwinds remain a critical concern for most investors, if not all, due to the possibility of a dividend cut in the near term.

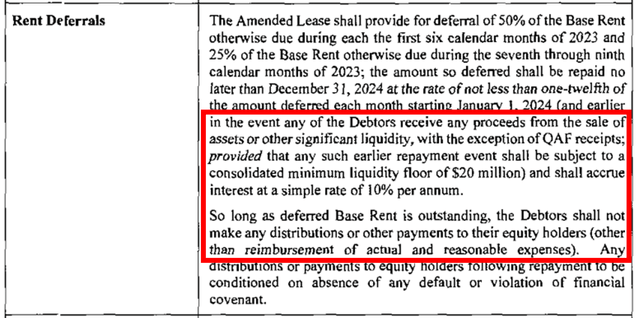

Court Filings From Pipeline Health's Bankruptcy

Pipeline Health

On the other hand, recent court filing has shown that MPW will be more than legally qualified in claiming its missed rental revenues from Pipeline Health, albeit at an elongated timeline. This development is crucial indeed, since the precedent may be applicable to other tenants, if they so choose to file bankruptcy in the future.

The company has obtained a judge ruling, in which rental repayment will be of higher priority than "other distributions or payments," on top of receiving earlier payments in the event of "any proceeds from sale of assets or other significant liquidity."

Particularly, the court reconfirmation of a "true operating lease rather than a financing arrangement" in the Pipeline case proves pivotal as well. It is due to the "pure rental type agreement" protecting MPW's existing REIT business model of renting physical assets to operators, against the financial lease arrangement, where all bankruptcy risks may be transferred to the lessee, which in this case means MPW.

We admit the legal process may be painful, one that has already impacted its stock price and investors' confidence thus far. Prospect's timeline to profitability in Pennsylvania appears particularly protracted at between twelve and eighteen months as well, attributed to the potential recapitalization/ sale of its managed care business worth $1B. These factors suggest more volatility in the intermediate term in our view.

So, Is MPW Stock A Buy, Sell, or Hold?

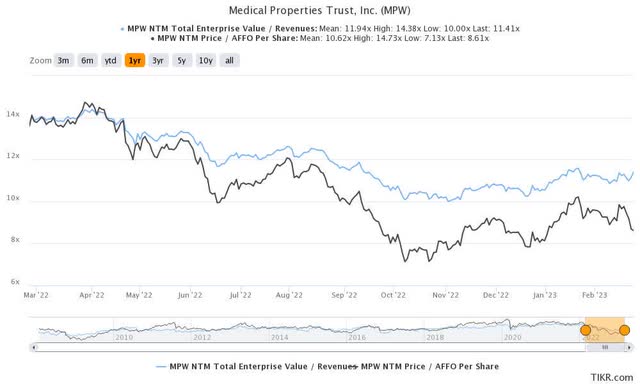

MPW 1Y EV/Revenue and Price/ AFFO Per Share Valuations

S&P Capital IQ

MPW is currently trading at an EV/NTM Revenue of 11.41x and NTM Price/ AFFO Per Share of 8.61x, relatively in line with its 3Y pre-pandemic EV/NTM Revenue mean of 11.85x, though lower than 12.71x, respectively.

Based on its projected FY2024 AFFO per share of $1.37 and its 1Y Price/ AFFO Per Share of 10.62x, we are looking at a moderate price target of $14.54. This nears the consensus price target of $14 as well, suggesting a 32.7% upside potential from current levels.

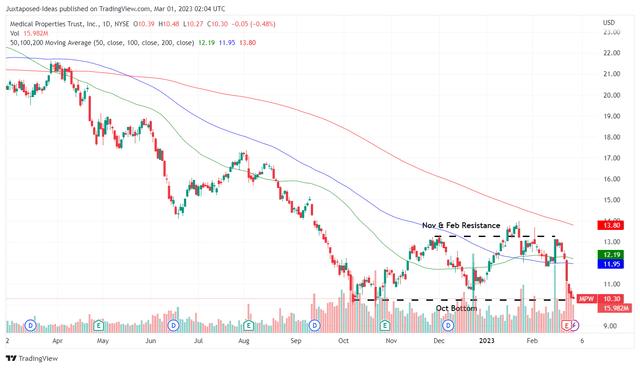

MPW 1Y Stock Price

Trading View

Due to the factors discussed above, it is apparent that the sell-off has been extreme. Many investors are concerned about MPW's dividend cut moving forward, one which we surmise as a potential risk, with three of its tenants experiencing either cash flow issues or bankruptcy. The company's situation is further complicated with the fact that Steward comprises 24.2% of its assets in FY2022, on top of Prospect's 7.5%.

Nonetheless, no matter how things develop for Stewart and Prospect, we are cautiously optimistic that the Pipeline court case may paint a slightly more promising picture for MPW and its dividend moving forward. This is significantly aided by the recycling of its current investment capital, with other tenants operating smoothly thus far.

Therefore, with a best case scenario of $0.29 quarterly dividends through 2023, based on FQ1'23's number, we may be looking at an expanded forward yield of 11.2%, based on its current stock price of $10.30. This potential yield is impressive, against the company's 4Y average of 6.02% and sector median of 4.34%.

As a result of the excellent dividend opportunity, we are rating the MPW stock as a speculative Buy here. Meanwhile, bottom fishing investors may attempt waiting for a better, single digit entry point, since the Fed may announce another rate hike by the end of March 2023, with the macroeconomic outlook remaining uncertain throughout the year.

Needless to say, this stock is only suitable for those with higher risk tolerance, significantly worsened by the elevated short interest of 17.46% at the time of writing, despite the drastic -19.85% plunge since February 15, 2023.

Business - Latest - Google News

March 05, 2023

https://ift.tt/bT0Ssfg

Medical Properties Trust: Dividend Safety Is The Biggest Question (NYSE:MPW) - Seeking Alpha

Business - Latest - Google News

https://ift.tt/FZQyvBw

Bagikan Berita Ini

0 Response to "Medical Properties Trust: Dividend Safety Is The Biggest Question (NYSE:MPW) - Seeking Alpha"

Post a Comment