(Bloomberg) -- The rapid selloff in Tesla Inc. shares has left most price targets from ever-bullish Wall Street analysts seemingly obsolete.

Most Read from Bloomberg

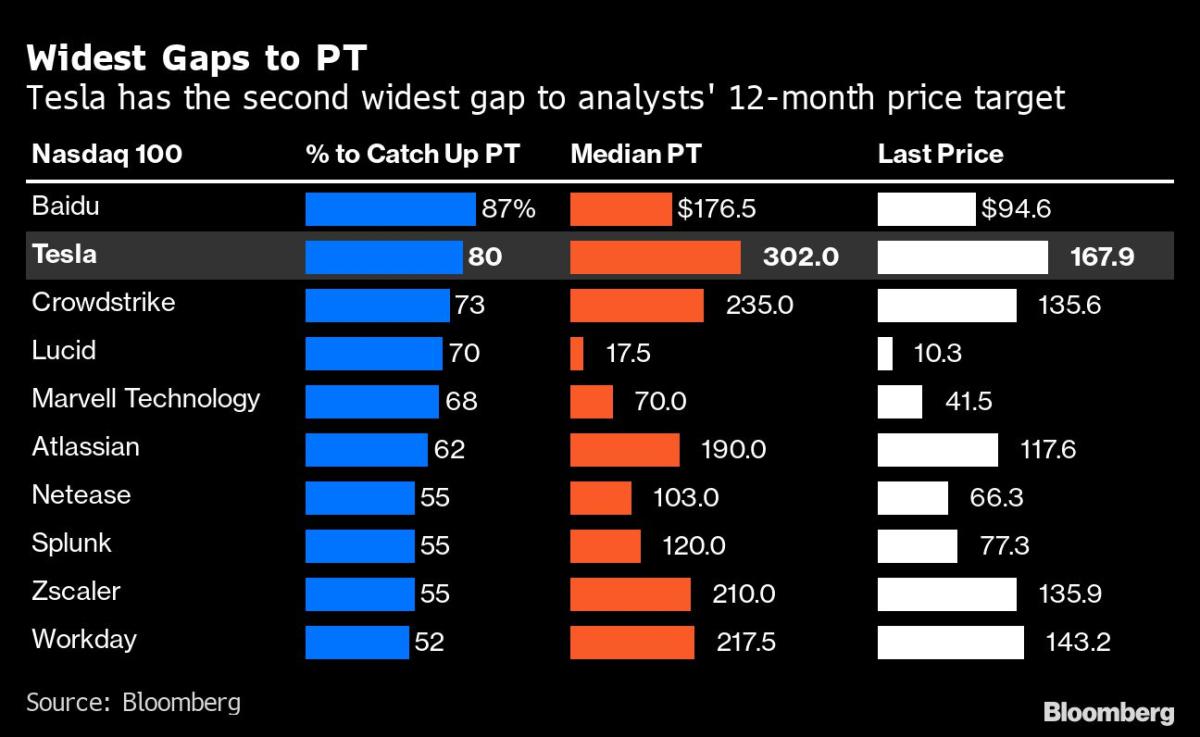

The yawning gap means Tesla shares need to rally a whopping 80% to hit the median analyst target price -- the second widest on the Nasdaq 100 Index, just behind Baidu Inc. The Elon Musk-led firm’s stock has slumped 52% this year to $167.87, while analysts have a median 12-month target price of $302. The stock was trading up 0.5% on Tuesday, set to snap a four-day streak of declines if gains hold.

Tesla has been facing a host of issues including Musk’s shift-in-focus on turning around Twitter Inc. to China’s return to Covid Zero curbs. Adding to that are supply-chain snarls, rising raw-material costs and buyers feeling the squeeze of stubborn inflation and rising interest rates.

Still, many analysts are sticking to their bullish calls, with 27 of them rating the stock a buy, while 11 have a hold and seven have sell. The most bullish call has a price target of $530, according to data compiled by Bloomberg.

“It could be very hard for the stock to recover in the coming years,” said Valerie Gastaldy, a technical analyst at DaybyDay. “We recommend not looking back and waving bye-bye to this old darling.”

The slump this year has taken Tesla’s market capitalization to a touch above $530 billion, a far cry from a trillion dollars in April.

(Updates to market open.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Business - Latest - Google News

November 22, 2022 at 09:35PM

https://ift.tt/UtsMSwa

Tesla’s Sinking Shares Leave Wall Street Analyst Targets in Dust - Yahoo Finance

Business - Latest - Google News

https://ift.tt/OIMkwPH

Bagikan Berita Ini

0 Response to "Tesla’s Sinking Shares Leave Wall Street Analyst Targets in Dust - Yahoo Finance"

Post a Comment